What is Consumer Price Index (CPI)?

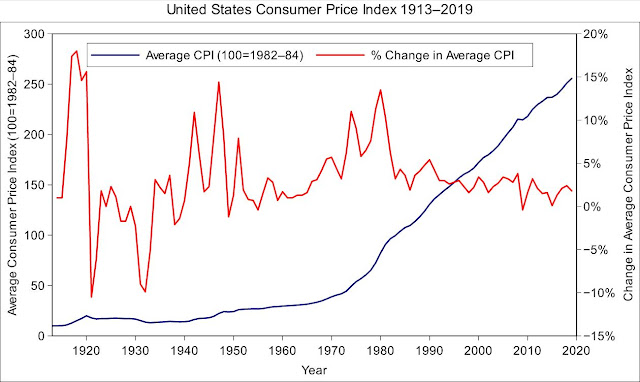

The consumer price index is an economic indicator and a measure of inflation. It is the weighted average increase in the household expense every month in each fiscal year. The household expense includes a basket of goods and services such as food and beverages, rental expense, education, entertainment, transportation, clothes, other essential services such as haircut, etc. CPI is calculated by aggregating the price change of all the household expenses as compared to the base year and averaging them.

To be specific, the price change for every item is calculated in the following way, each item in the basket is assigned a different weight depending upon many economic factors and later multiplied with the price change of that particular goods and service. In other words, the CPI index denotes the average price change in the goods and services over time. For example, if the weighted average price of consumer goods and services for the year 2008 is $100, while in 2009 the same goods and services are worth $120, then, in this case, the net CPI is 20%.

Effect of CPI on Purchasing Power:

The consumer’s purchasing power increases when the aggregate price level decreases and vice versa. In other words, the value of the dollar falls in case the price of goods and services increase.

A large rise in the CPI levels in a very short period of time is called a period of inflation whereas a large drop in the CPI levels is termed as a period of deflation. If the CPI index is under control then it is believed that the economy will do good and we can expect good returns from the Stock market. (To know more about the stock market, refer our most popular article: Basics of Stock Market)

FYI, when the inflation rate is much more than the expected rate, for example, a 14% increase in inflation indicates a hyperinflation situation. (We will know much about hyperinflation in our next post, so stay tuned)

Who is responsible to control inflation?

It is the responsibility of the Central Bank (E.g. RBI, in case of India)

and the government to keep inflation levels under control and thus they come up

with different economic policies which also includes creating a limit for CPI

inflation every year, where the goal is to keep the inflation between the said

limits. For example, In India, the increase in the CPI index should be between

2% to 6%. More than 6% indicate that Inflation is more than expected and it

creates a negative impact on the economy. Even inflation of less than 2% gives

a negative impact as it is believed that the companies are not able to increase

the prices of their goods because the consumers are not having sufficient

purchasing power and they are not ready to spend more, hence the prices are

reduced because of low demand.

CPI calculation formula (for single item)

Who calculates CPI?

CPI index is nothing but the household expenses inflation, however, it is important to monitor this index regularly and hence there are some international organisations like “Organisation for economic co-operation and development” who are responsible for reporting the CPI figures (monthly, quarterly or annually) for many of its member countries. For instance, in the United States, the CPI figures are calculated by “Bureau of economic analysis” and in India, the CPI is calculated by “Ministry of statistics and programme and implementation”

Final Words:

CPI is one of the most important and closely watched national economic

indicators. It is an ideal tool for calculating actual inflation figures at a

consumer level and most importantly it is accepted all over the world.

Thanks for reading

If you have any queries, you can drop me a mail at thefinancemagic@gmail.com or you can drop a comment in the below comment section and we will get back to you as soon as possible. Till then check out our other popular articles

- Mutual fund for Beginners - The Complete Guide

- Best Finance Books Ever Written!

- A Complete Guide on the Stock Market

Let’s spread financial literacy together.

Do subscribe to get notifications of the latest articles.

Thanks for reading.

The Finance Magic

1 Post a Comment:

Click here for Post a CommentYou have given essential data for us. about Tax CPA In Santa Barbara It is excellent and good for everyone. Keep posting always. I am very thankful to you.

Please do not spam ConversionConversion EmoticonEmoticon