What is an

annual report?

Annual report is a public document

issued by the company at the end of every financial year which contain the details of the company with respect to the business model, the financial

statements and many more. We will be breaking down “How to read annual report”

in much detail in this article.

Annual report is audited by the

independent auditors appointed in the annual general meeting and thus the

information provided in these documents is assumed to be “true and fair”. Any

discrepancies or misleading information in annual report is considered as a

severe offence which can go against the company.

Annual report is issued by the

company to the shareholders and other people who have interest in the company’s

business such as creditors, bankers, potential clients and shareholders, etc

(also known as stakeholder). Annual report of all the past financial years can

be found on the company’s website under the “investor relation” section. These

documents are very useful as it gives insights into the business and where does

the company stand as compared with its competitors.

Important

sections in an annual report:

While annual reports are reliable and

trustworthy but certain companies try to manipulate it by adding a lot of

marketing content, which has no relevance and hence an individual investor

should be aware of what sections are relevant to him and should not fall for the marketing trap.

In order to make this article more user

friendly, we will review the annual report of the company “Huhtamaki PPL Ltd.”

(You can download the same by clicking here)

1. Financial Highlights

A company usually starts with disclosing

some important financial numbers such as revenue and profit for the year and

also introduces the investor with some of their most popular products of the

year, if any. It gives a fair understanding of the business products and how

well they performed with respect to sales, profit and market share.

Below is the snapshot of Financial

highlights from Huhtamaki PPL (AR Pg. 20)

2. Director’s letter to shareholder

This section tells us about the decisions made by the company in the previous

financial year and their impact in the future. The director conveys his message

about the company’s vision, performance, projects and much more with the

shareholders.

Below is

the snapshot of Director letters from Huhtamaki PPL (AR Pg. 22)

3. Management discussion and analysis (MD&A)

This is

one of the most important section as it gives the overall picture of the

company. The section usually starts with an introduction and business model of the

company. It gives detailed information about the industry in which the company

operates and the growth outlook for the overall industry. If the company

operates in the international market, the section would also mention the global

economic outlook which can impact the industry. It talks about all the recent

developments, exports, initiatives, tax implications, development of the

economy, risk in the business, etc.

(This section teaches a lot of stuff which an

investor need, it is so powerful that if we read this section of three to four

companies who are in the same industry then we could be an expert of that

industry.)

Below is

the snapshot of MD&A from

Huhtamaki PPL (AR Pg. 22)

Also, Check out Most Recommended Finance Books by World Leaders

4. Corporate Information

These

section gives detail about the company’s key managerial personnels, bankers,

auditors, registered offices and headquarter address, research and development

centres, etc. It also provides information about the subsidiaries and the company’s

share of interest in those subsidiaries. (You may also check the corporate

governance section to get detailed information about the promoters and board of

directors)

Below is

the snapshot of Corporate Information from Huhtamaki PPL (AR Pg. 125)

5. Shareholding pattern

This

section discloses the total shareholding of Promoters, Domestic

Institutional Investors (DII), Foreign Institutional Investors (FII), Retail

investors and others. (Lower promoter's shareholding is a sign of concern.)

Below is

the snapshot of Shareholding pattern from Huhtamaki PPL (AR Pg. 65)

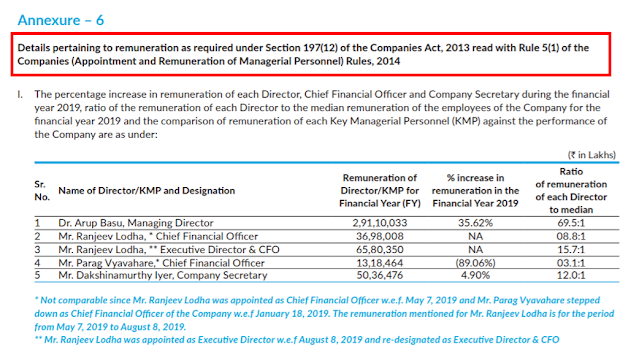

6. Remuneration of directors and key managerial personal

This

section tells us about the remuneration/salary paid to the directors and KMP

and also let us know what is the ceiling as per the act for the salary payment,

basically, the ceiling set by companies act is 10% of net profit, usually the

company’s pay salary around 4 to 5% of net profit. It also talks about the

amount paid to the board of directors and committee members for attending board

meetings, it should not be too high which could indicate something fishy going

on in the company. (For example, One crore per meeting is not justifiable)

Below is

the snapshot of Remuneration from Huhtamaki PPL (AR Pg. 51)

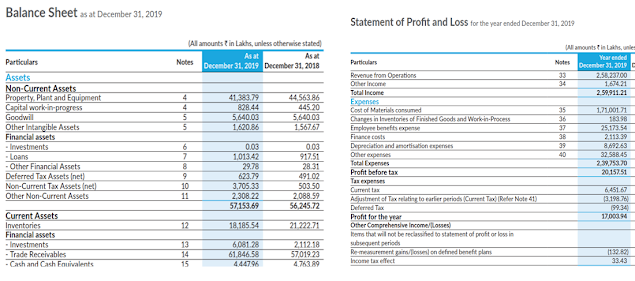

7. The Financial Statement

Last but

not the least, the financial information is one of the most important and

crucial aspect of any business and is very important to analyse this section.

It contains three financial statements:-

a. The profit and loss statement

b. The balance sheet

c. The cash flow statement

If the company has multiple subsidiaries and all of

them are into the same business then one should look at the consolidated

financial statement and if the company does not have any subsidiary or have

subsidiary but they are into some different businesses than in such case one

should look at standalone financial statements.

Keeping the above point in mind we should always

analyse the consolidated figures as it gives the overall picture of the

company’s business. In our next article, we will be discussing in detail about

all the three financial statements and how to understand which line items are

the most important and what are the signs of a fundamentally strong company?

Below is the snapshot of Financial statements from

Huhtamaki PPL (AR Pg. 84)

8. Contingent liabilities and commitment

These are

the liabilities which might or might not occur in the future. For example, If there is some ongoing lawsuit against the company, and if lost, the company might have to pay a huge chunk of penalty,

income tax dues, sales tax dues, etc. Such liabilities are not shown on the balance sheet. They have a separate segment to disclose contingencies.

These are some of the important sections

one should keep in mind while analysing or reading an annual report. There are different perspectives of every individual to look at it. This was just an

overall and a simplistic example on “How to read annual report”. The more you

read the more you understand, as I have mentioned above pick up an industry and

try to read the annual reports of different companies of the same industry, as

you will move forward there will be lots and lots of learning and eventually, you would be able to pick up the best companies. Each of the sections will be

covered in detail and we will let you know how to analyse the above sections part

by part in our upcoming "Fundamental Analysis Series". (We will attach the links as and when

updated)

Till then don’t forget to check our most popular post “12 Pointers Checklist to pick a Multibagger Stock”.

Do subscribe to get notifications of the latest

articles by CLICKING

HERE.

Check out our popular articles:

If you found this article useful then do comment your questions or view in the comment box below, and share it with all your family

and friends. Lets spread financial literacy together.

Thanks for reading.

- The Finance Magic

Please do not spam ConversionConversion EmoticonEmoticon